You ever have a feeling that your on the precipice of something, but can’t see 6 inches over the ledge? That’s how I feel about IBM storage after the sale of IBM’s server business to Lenovo. You look at some of the post sale news articles, employee postings on the IBM alliance web page and you get this feeling that stability for this sector at IBM is anything but solid. This could be said for a lot of storage vendors out there today with the direction of commodity storage, storage start-ups and cloud outsourcing starting to take its toll upon the big rack and stack storage vendors.How quickly these type of vendors like IBM can start to make a play into one or more of these fields will decide how healthy they can remain in the storage sector.

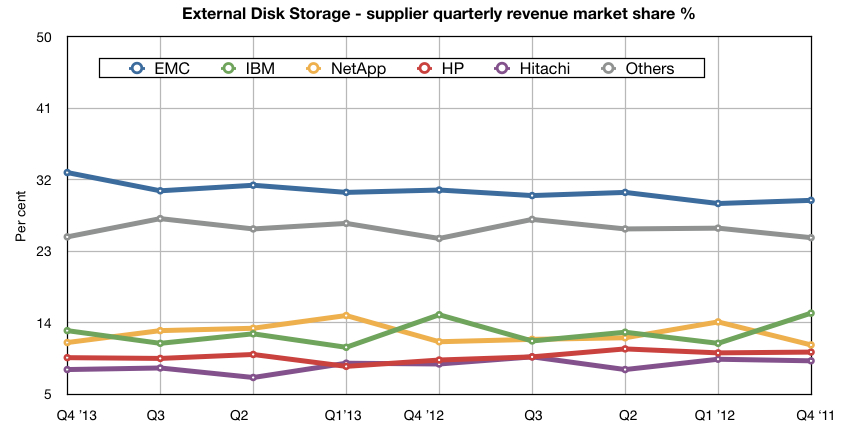

I stumbled across this below graphic from a Register article about storage woes for NetApp.

We can see that IBM on this chart has its ups and downs like many vendors, but like the rest after each set of four quarters the next set has a slightly reduced peak sale point. I think the main part of this reduction is partly attached to the above mentioned sector shifts to new storage consumption models, but also I think the questions of the Lenovo sale for the server business more than likely stalled sales staff with deals that combined storage and server components.

IBM has a very eclectic and varied set of storage offerings which many like Storewize, FlashSystem and XIV have plays into the new directions. The key question is can IBM position well enough into these areas in a timely and cost-effective way. Time will always tell, but with the previous Lenovo sale and the unknowns for where all the storage products will land we could be in for a bit more of the following…

With IBM’s drive to improve share price we may see some sales or shutdowns of under-performing storage solution lines. Again time shall tell.

March 16th, 2014

March 16th, 2014  Christian Weidelman

Christian Weidelman

Posted in

Posted in